Financial Technology, nowadays better known under the term ‘Fintech’, describes a business that aims at providing financial services by making use of software and modern technology. The term financial technology can apply to any innovation in how people transact business, from the invention of digital money to double-entry bookkeeping. Nigeria as we know it, is blessed with an abundance of intelligent minds. Today, I’ll be discussing 4 Fintech startups in our country that are making waves in 2018

1. Paystack

Paystack was founded by Shola Akinlade and Ezra Olubi. It initially caught the eye of industry commentators as it was one the first Nigerian tech companies to be accepted into the world-famous Y Combinator progam, based in Silicon Valley.

Since then, having taken Paystack through Private beta, and securing $120,000 early-stage investment from Y Combinator, Akinlade [CEO] and Olubi [CTO] have quietly been building the company, working to secure this Seed investment round, whilst also building a network of partner merchants in Nigeria, over 1,500, who are now using the platform to accept online payments.

Paystack is one of Nigeria’s hottest fintech startups. They were featured on forbes for securing $1.3M Seed investment from both international and homegrown investors when they started. As of now, some of their customers include hotels.ng, irokoTV, Jobberman, Printivo, Gigalayer, Payporte (the official sponsor of Big brother naija), amongst other businesses selling to their customers online.

2. Piggy Bank

Piggybank.ng is a Nigerian Financial Technology (Fintech) startup and they run a simple online savings scheme where they make periodic deductions for customers to save towards targets.

Their clients also earn interest income on the savings made. All that is required is to link a debit card to their platform online only. I was at first intrigued by the name. It is catchy and straight to the point. It is a savings product and nothing more. As a Financial Technology company, I wondered if they had approval from the Central Bank of Nigeria to use the term “bank.”

I later found out that they had all bases covered and were powered by a Microfinance bank. “Piggy bank” itself is a generic English term used to denote the earliest means of storage of money, using a hollow ceramic statue of a pig. Piggybank.ng uses the highest levels of Internet Security, and it is secured by 256 bits SSL security encyption to ensure that your information is completely protected from fraud

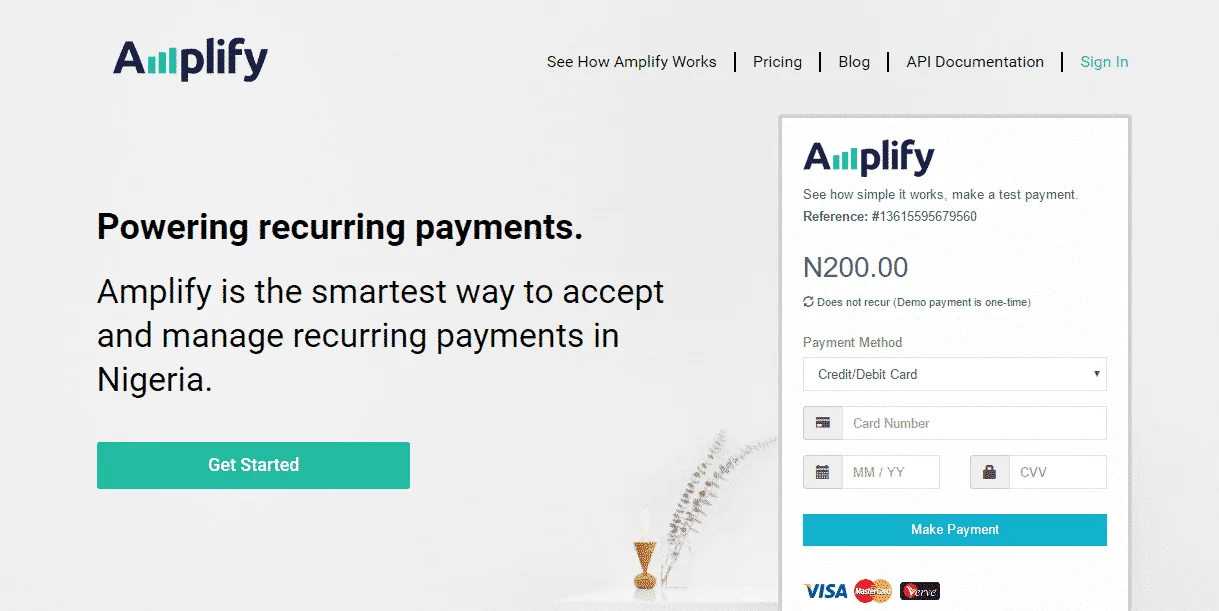

3. Amplify

Amplify is a payment solution that helps African businesses accept and manage recurring payments from their customers using their cards or directly from their bank accounts. It was formerly known as SlushPay. Amplify has a proprietary technology that intelligently routes and retries transactions to increase the success rate of transactions.

They serve consumer loan companies, internet and content service providers, hosting services and other subscription type businesses. Because Amplify has a unique focus on recurring type payments, the platform provides a subscription management system that helps businesses view, monitor, update, cancel and generally manage their customers’ payments and subscriptions. Amplify also provide other value added services that helps businesses grow.

This includes deep insights and analytics that helps business managers make better decisions, engagement tools via email and SMS, loyalty programs, amongst others. ‘Amplify Payment Forms’ also helps small businesses and startups accept electronic payments in less than five minutes. Users can simply login to the platform and generate payments links.

Afterwards, they may share this link with their customers. Customers can buy and make payments for goods and services using the link.

4. Paga

Paga is a mobile payment platform that allows its users to transfer money and make payments through their mobile devices. Paga acts as a mobile wallet where any user equipped with a mobile device can conduct transactional activities using their device

Paga was introduced in Nigeria to take advantage of the cash buildup in the system and to create a means whereby financial services are available to all. Although the banking sector in Nigeria is not easily accessible to everyone, the telecommunications industry has been more successful in reaching a large proportion of the country’s population.

The collaboration of both the banking and telecom sector has given rise to mobile banking platforms like Paga, where a user can perform basic financial transactions with the use of a cell phone. Paga works through a mobile phone application or online through the company’s website. With Paga, customers are able to deposit and save money, purchase pre-paid phone credit, pay utility and cable bills, and make payments to retailers. The partnership between Paga and Western Union also has the added benefit where Western Money transfers sent to users can be deposited into the users’ Paga accounts.

So there you have it, 4 fintech startups making waves in Nigeria in 2018. Do well to drop a comment on what you think. Where do you see the fintech industry of Nigeria in the next ten years? Which of these companies are you familiar with? Are you secretly working on building your own fintech platform? 😉 Your comments will be duly appreciated.

If you enjoyed reading this, you may also want to check out our article on Co-working spaces in Lagos and their prices